瀚亞投資2021年發布《亞洲固定收益調查》,針對來自美國、歐洲以及北美洲的近200位機構和大型投資者進行調查,探查對亞洲固定收益的最新看法和投資意向。調查結果顯示,全球投資者都在尋找多元化資產,以及提高固定收益的收益率,希望透過亞洲市場來實現。

亞洲固定收益 投資態度樂觀

瀚亞投資(新加坡)策略投資長黃文彬(Ooi Boon Peng)表示,全球增長和通膨前景不明朗所帶來的焦慮,讓受訪者更傾向多元化的投資組合,並且增持新型固定收益資產。雖然亞洲債券市場波動加劇,但大多數受訪者仍抱持樂觀態度,尤其是中國債券,在未來的12個月中可能增持。

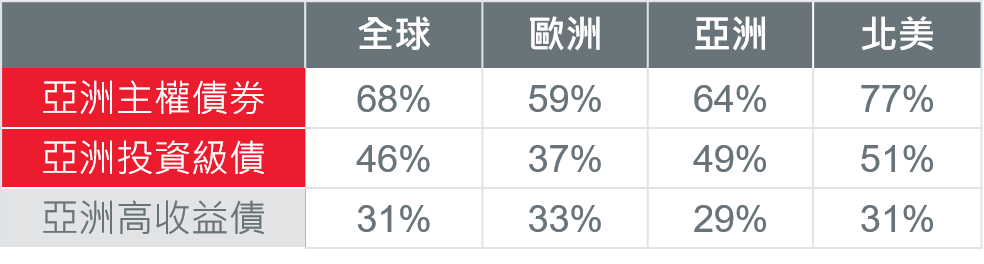

調查結果顯示,大多數人認為亞洲固定收益資產的風險調整後報酬率,高於已開發國家,對於高品質的亞洲主權債券和投資級債券的興趣度逐漸增強。雖然亞洲各國的經濟狀況多有不同,但多數亞洲市場都具備投資級主權信用評級,該地區擁有穩定的經濟基礎。相比成熟國家市場,亞洲的政府債券和企業債券收益率更為誘人,可做為擴大投資組合種類及提升整體收益率的新途徑。

調查結果摘要

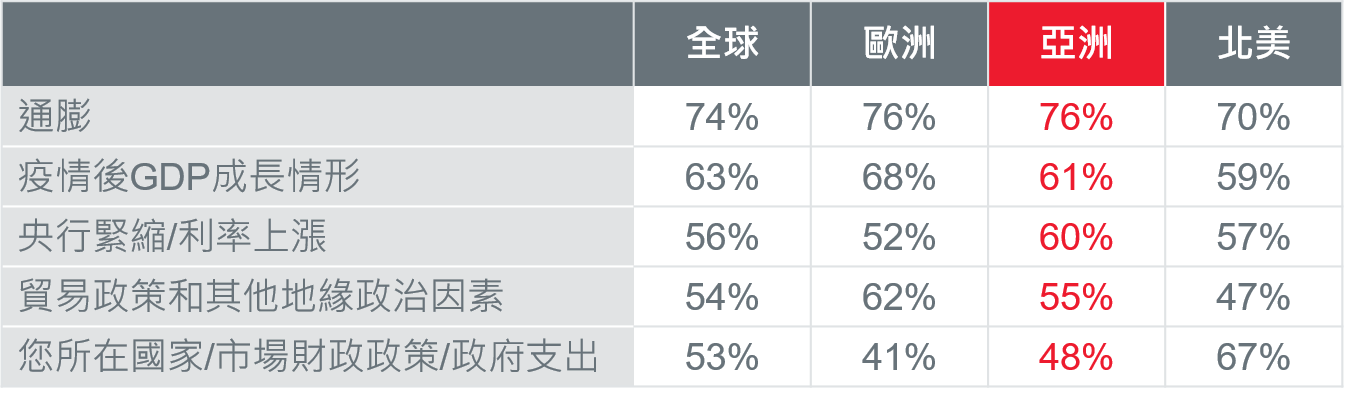

Q1. 哪些因素將實質影響固定收益的投資組合?

近四分之三的受訪者選擇通膨,且在所有地區的受訪者中,都將通膨列居首位。此外,對於經濟增長的不確定性及利率變化等因素,也推動對固定收益投資的重新評估,利率政策改變將加劇全球政府和企業債的波動。

在全球受訪者中,高達70%的人表示,將在未來兩年內進一步擴大債券類別,更多元化持有債券,亦將增持新類型債券,且在收益率考量下,進而轉向亞債靠攏。

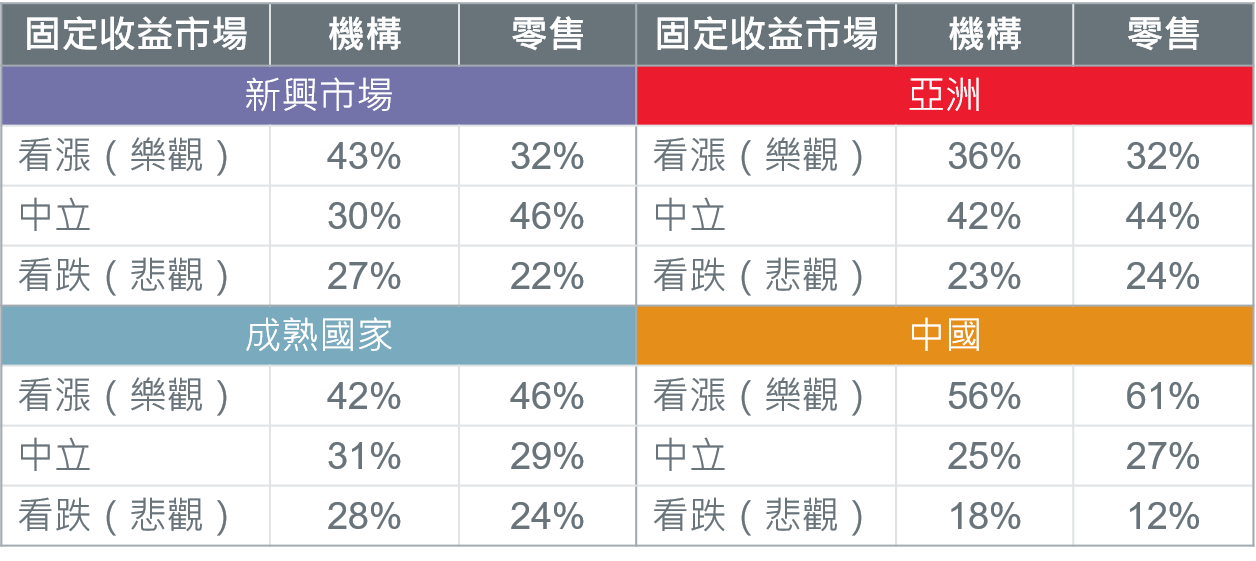

Q2. 固定收益各主要市場中,最看好誰?

由於成熟國家市場債券收益率有限,以及與其他資產類別的關聯性,使投資者開始向亞洲市場靠攏。約三成受訪者表示,對亞洲固定收益投資抱持著「看漲/樂觀」態度,看好中國債券的比重更高達五成以上。

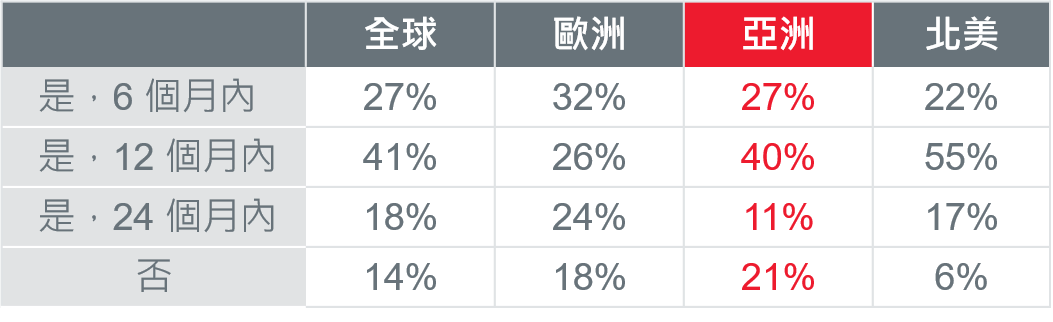

Q3. 未來對於亞洲固定收益的投資意向如何?

投資者對未來亞洲固定收益的潛在收益率期待很高。超過70%的全球受訪者認為,在類似風險條件下,亞洲固定收益回報率往往高於成熟國家。全球約三分之二的受訪者表示,2022年可能會增持此類資產,尤其對優質債券如主權債券和投資級債券的熱度最高。

Q4. 如何選擇亞洲固定收益標的與資產管理公司?

在選擇投資亞洲固定收益的資產管理公司時,受訪者普遍認為,會綜合評估投資專業人士及團隊的才能、反應能力和專業知識制定決策。

進一步問及考慮因素時,近半數受訪者表示,資產管理公司必須能夠提供符合其要求的固定收益投資解決方案,此外,對亞洲債市的資訊掌握程度和專業知識也很重要。超過40%的投資者表示,必須建立基於本地市場的客戶服務團隊,才會考慮讓該公司管理其亞洲固定收益資產的配置。

亞洲債券 多元投資組合的必鑰資產

透過這份調查結果與見解,希望提高投資人對亞洲固定收益的認識和興趣,亞洲債券將在全球投資組合中,扮演重要角色。

瀚亞投資(新加坡)總經理Seck Wai-Kwong表示,瀚亞投資是亞洲最大的固定收益投資管理機構之一,我們深入當地市場為客戶提供客製化投資方案,協助其在當地貨幣及外幣計價的亞洲債券市場。雖然亞洲債券已發展成為重要的資產類別之一,但市場尚未飽和,仍有許多有利的機遇,等待資產管理公司挖掘與投資人的參與。