全球通膨上升及升息導致全球債券價格於2022年迅速重新調整。6月,聯準會進行了自1994年以來最大的一次升息。截至本文發稿時,美國十年期國債收益率已從一年前的僅1.5%升至3%,為十年來最高水準1。雖然亞洲債券受美國收益率上升所影響,但中國2022年上半年成長放緩,進一步打擊投資人對亞洲及新興市場資產的投資情緒。

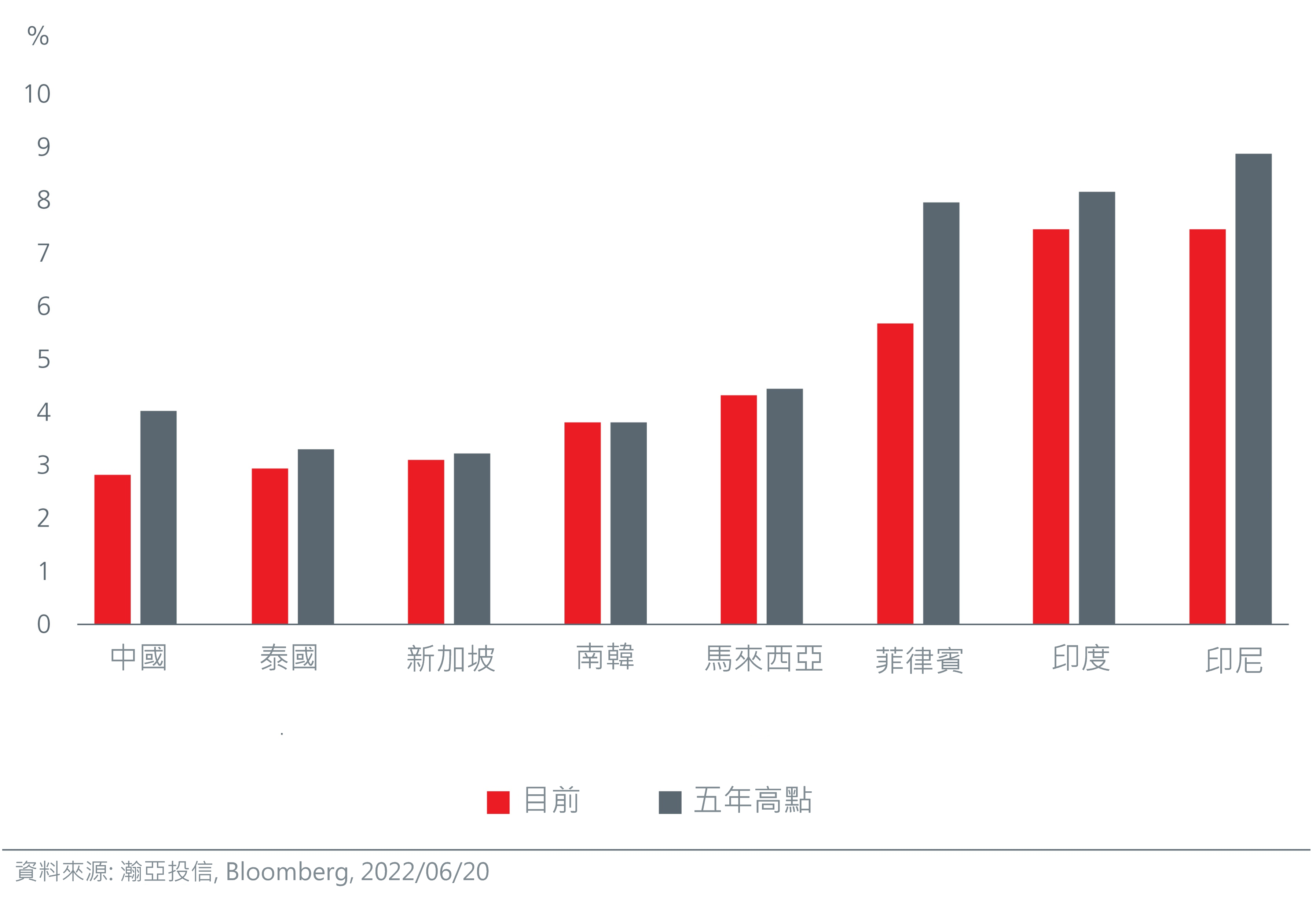

我們注意到,目前大多數本地貨幣十年期債券收益率接近五年來的高位,其中許多已超過此前2018年聯準會升息週期時的高位(圖1)。我們認為,如今亞洲債券收益率上升,為投資人帶來具吸引力的債券投資入市機會。

圖1.亞洲本地貨幣政府債券收益率

同時,多數亞洲收益率曲線相較於歷史平均水準的陡峭程度表明,投資人在其投資組合中增加長期債券是可行的。倘若市場風險情緒穩定下來並得以改善,我們預計收益率上升及更具吸引力的信貸息差或許會提升亞洲債券報酬。

中國經濟最艱難的時期已經過去

中國經濟需要回復穩定,投資人的情緒,特別是對亞洲資產的情緒才會改善。就此來說,中國政策制定者已宣佈以減稅形式加大財政支持。基礎設施投資亦將成為一項重要的成長動力。中國國有政策性銀行被要求為基礎設施項目設立人民幣8,000億元(1,200億美元)的信貸額度。在貨幣寬鬆方面,中國人民銀行已削減存款準備金率、貸款優惠及抵押利率。進一步的寬鬆政策可能包括注入流動性、有針對性的信貸支援以及進一步減息。

房地產產業佔中國GDP的20-25%,該產業的穩定對中國經濟至關重要。儘管5月的簽約物業銷售額繼續獲得年增大幅下跌,但優質發展商的年增跌幅較小。隨著封鎖措施逐步放寬與消費者信心恢復,銷售額有望回升。中國人民銀行亦一直鼓勵中國優質房地產發展商收購財困發展商的房地產項目。這有助於降低產業違約率。我們預期下半年房地產產業會頒布更積極的寬鬆及支援措施,其中可能包括地方政府放寬預售資金限制,以及進一步放寬一線城市的抵押貸款與購房限制。

因此, 2022年第二季度中國經濟最艱難時期已經過去,但是逆週期措施還需要時間才能在實體經濟中體現出來。同時,2022年下半年,中國人民幣應會更加穩定。正如扶持性經濟政策,中國當局亦可能希望祭出穩定的貨幣政策。這應該進而有助穩定亞洲區的貨幣。

高評級企業的信貸基本面依然穩健

甚至在美國聯準會開始升息前,貿易額成長就已放緩。隨著全球放寬新冠疫情限制措施,消費很可能持續從商品轉向服務消費。在此背景下,相較更加依賴貿易的亞洲經濟體來說,國內人口數目眾多的亞洲經濟體料將有更佳表現。東協經濟體應將持續受益於經濟延遲重啟:這對於經濟高度依賴於旅遊業的泰國來說,應尤為有利。2022年,馬來西亞及印尼等依賴商品出口的經濟體亦應會實現GDP強勁成長。

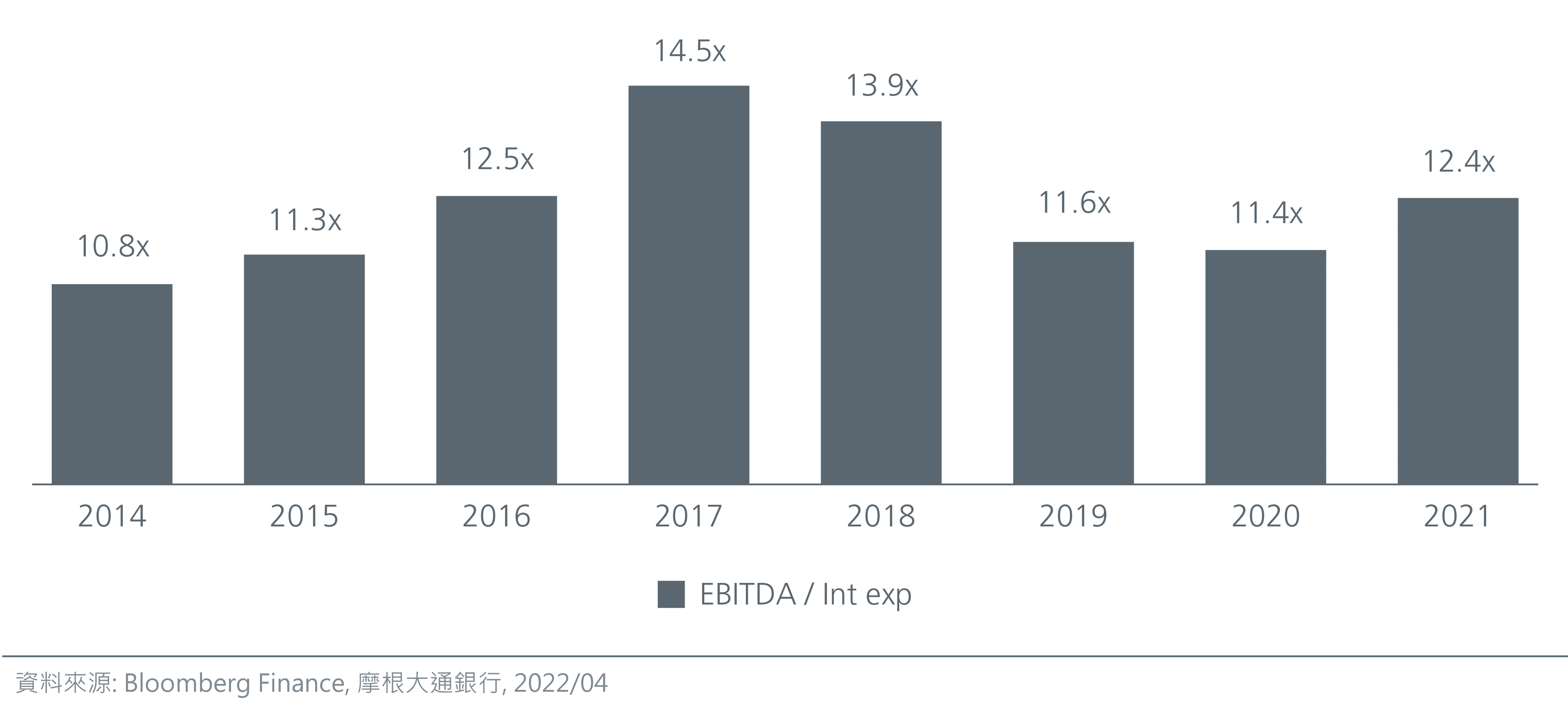

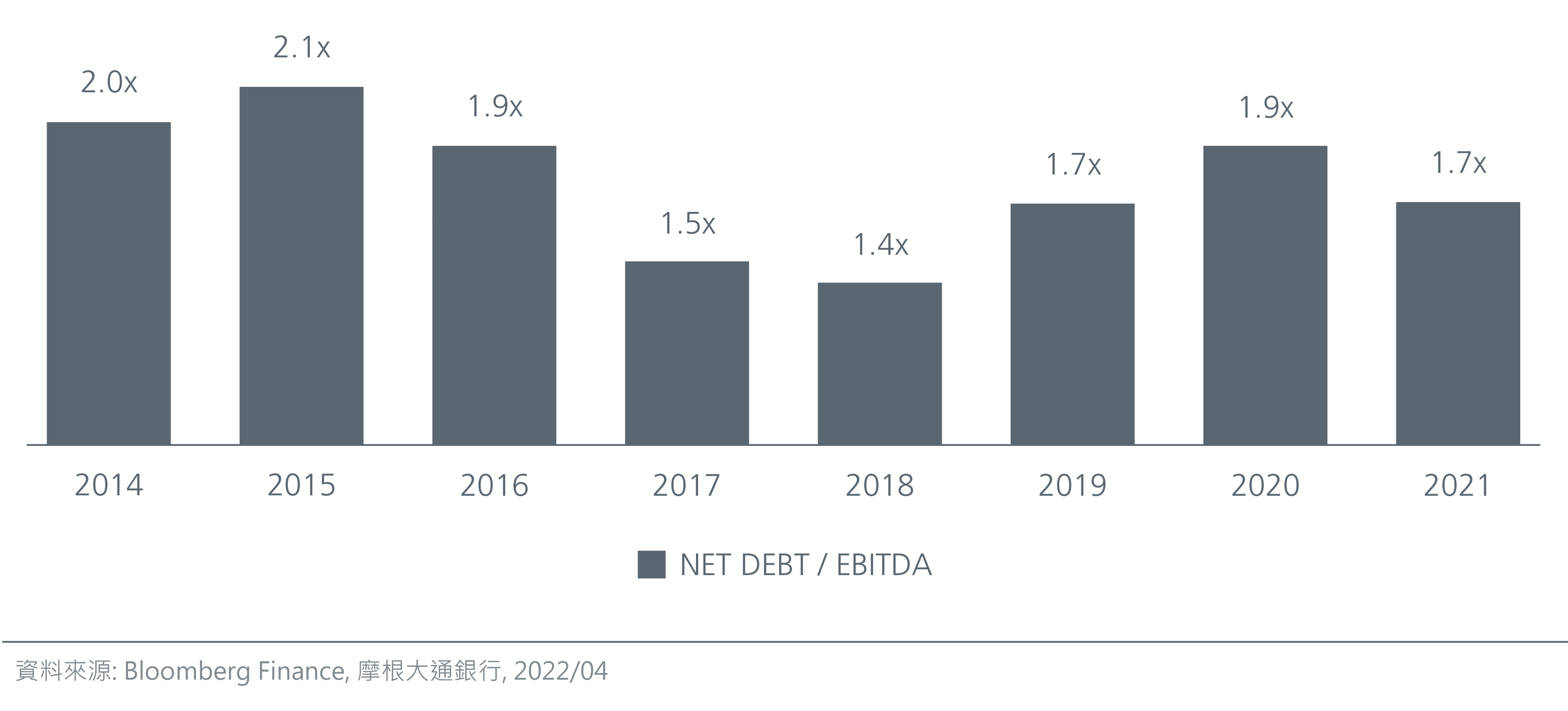

我們注意到,企業基本面(尤其是亞洲優質公司的基本面)依然穩健。實際上,對於亞洲投資級企業來說,槓桿率及利息覆蓋率已基本恢復至新冠疫情之前的水準。由於借款成本降低,利息覆蓋率得以改善(請參閱圖2)。淨債務╱稅息折舊攤銷前利潤亦已下降,表明亞洲企業償清債務所需時間減少(請參閱圖3)。

圖2.利息覆蓋率得以改善

圖3.亞洲高評級企業正加速償還債務

鑒於企業資產負債表依然穩健,加上年初至今亞洲債券市場拋售後息差擴大,亞洲投資級信貸的風險報酬狀況正在不斷改善。

亞洲升息很可能更謹慎有度

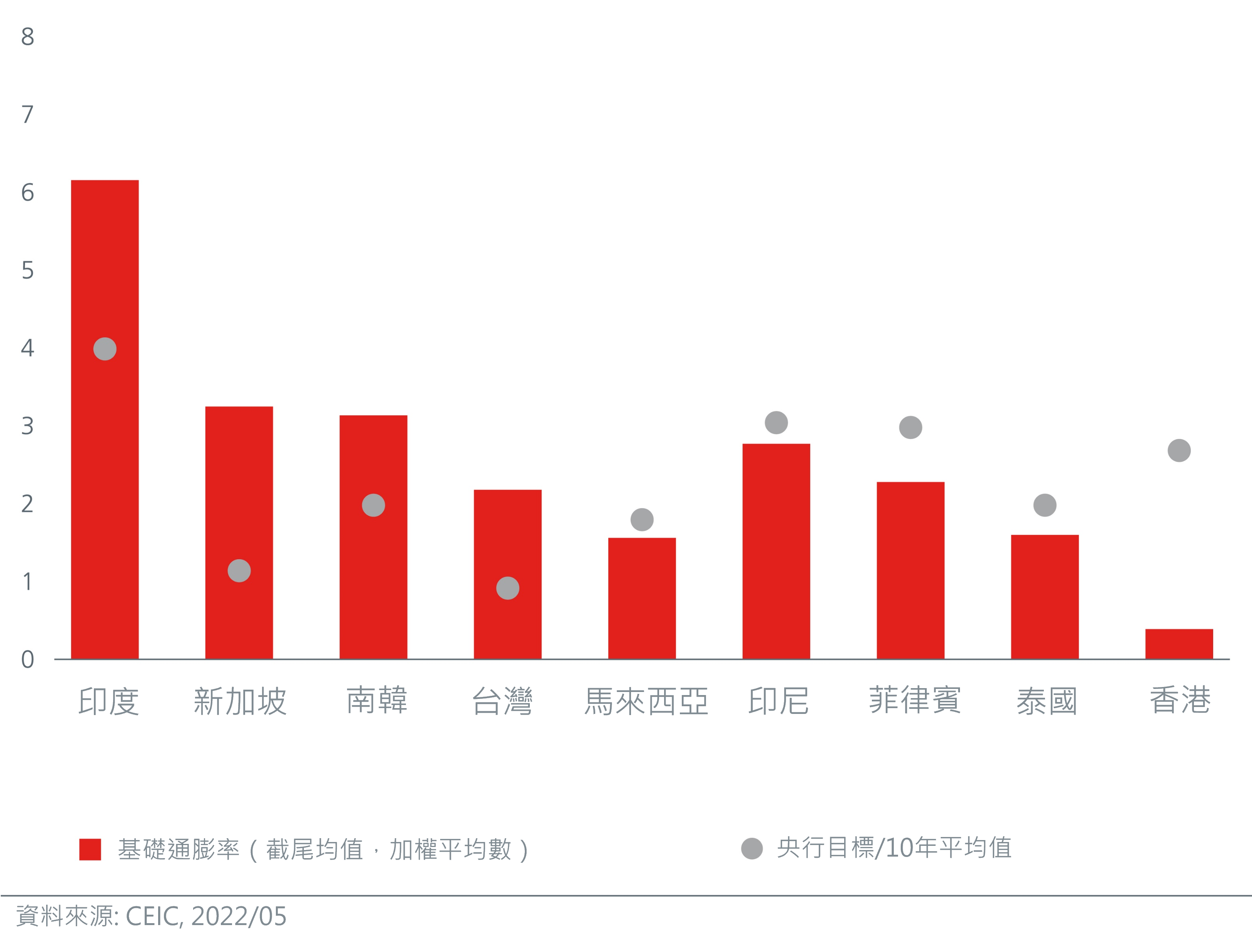

供應鏈中斷、能源價格飆升及經濟重啟的壓力令商品價格上漲,推高了亞洲通膨率。新加坡、南韓及台灣通膨率高於央行目標,這些收入較高的大部分經濟體均已控制新冠疫情,令經濟活動恢復或超過潛在水準(圖4)。因此,該等經濟體的央行亦在該地區率先收緊貨幣政策。

圖4.通膨率與央行目標的比較

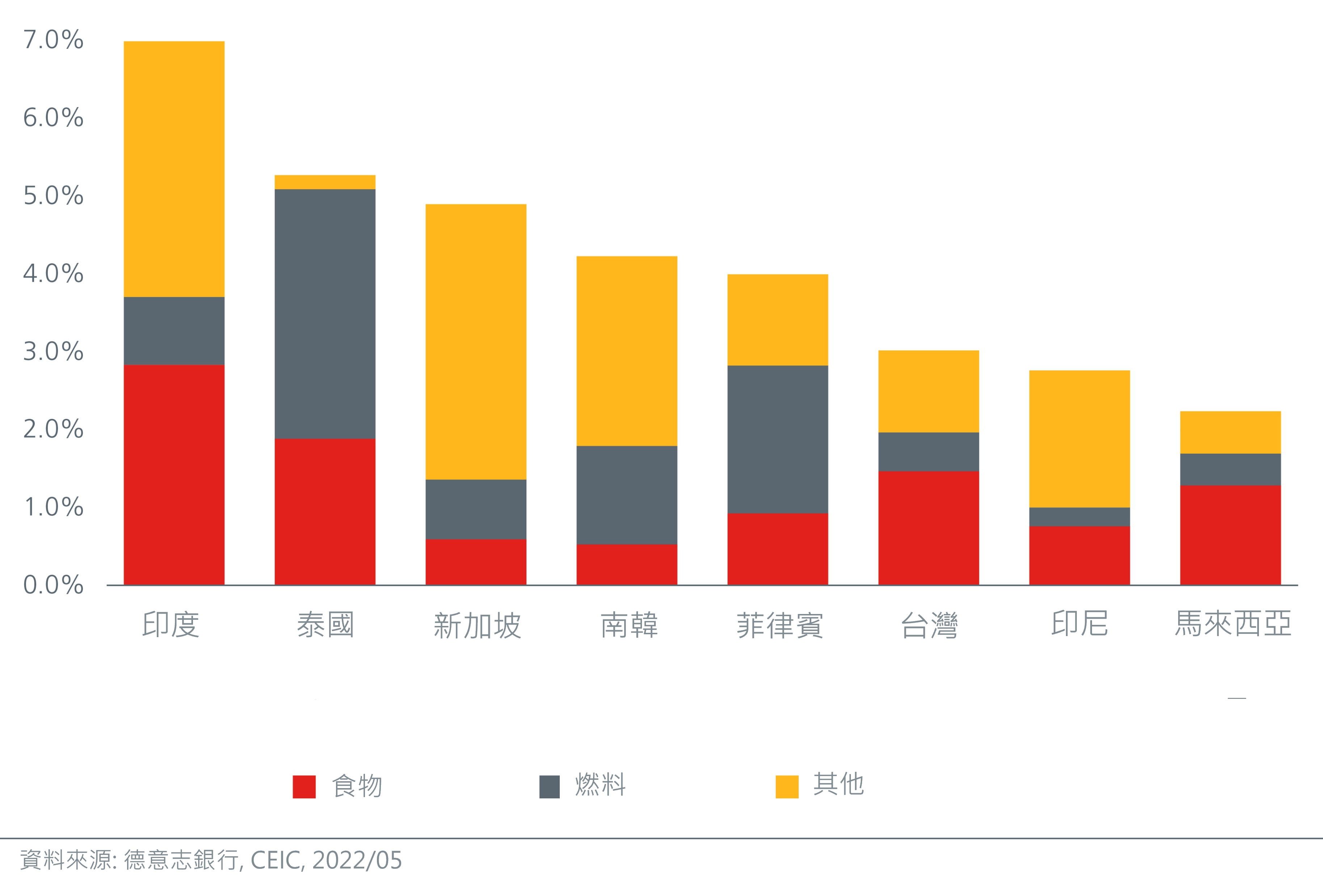

印度、印尼、馬來西亞、菲律賓及泰國此前一直致力控制新型冠狀病毒Delta變異株疫情,但目前隨著免疫水準提升及社交距離限制措施放寬,政策制定者正重新關注通膨。雖然亞洲升息步伐加快,但是亞洲央行的升息立場很可能不如聯準會那般激進。該地區通膨中食品權重較燃料權重大3至4倍(請參閱圖5)。由於食品價格上漲乃由於供應鏈中斷所致,利率升高不太可能有效降低價格。因此,亞洲各國央行可能祭出補助等非貨幣性措施,應對供應造成的食品通膨。儘管如此,食品價格上漲及其對通膨的影響,應受到持續觀察。

圖5. 對整體通膨率的貢獻(過去3個月的平均值)

同時,隨著美國成長動能放緩,美國的通膨壓力可能見頂。儘管2023年美國經濟衰退並非我們目前的基本預測,但我們注意到,由於關鍵經濟數據低於普遍預期,花旗美國經濟驚奇指數於5月下滑。市場最終可能會降低對聯準會未來升息幅度的預期。

由於經濟重啟,消費從商品轉向服務消費,供應鏈中斷帶來的美國通膨壓力亦可能有所紓緩。需求放緩以及美國頁岩油產量增加,可能帶動能源價格下降。最後,隨著汽車產量的增加,美國通膨的關鍵驅動因素之一——二手車價格,有所降低。通膨壓力見頂將限制美國債券收益率,進而限制亞洲債券收益率。

債券投資人面臨的獨特機會

亞洲債券收益率見頂及該區謹慎有度的升息措施,以及亞洲優質企業信貸基本面保持穩健,為投資人提供了更具吸引力的報酬及多元化投資的潛力。隨著中國成長風險消退,資金可能回流至亞洲債券,進一步支撐價格。亞洲總體、通膨及貨幣前景的差異,亦為積極投資人提供了長期管理、信貸選擇及貨幣押注方法提高報酬的機會。