摘要

面對宏觀經濟形勢瞬息萬變的環境,亞洲當地貨幣債券市場逐漸成為受全球投資人青睞的投資目的地。美國財政赤字增加、美元走弱、亞洲大部分地區通膨溫和以及亞洲市場實際報酬率較高的多重因素為相關資產創造了利多環境。對於尋求分散投資、收益及抗跌力的投資人而言,亞洲當地貨幣債券的吸引力幾乎前所未見。

美國財赤攀升,重塑投資格局

我們在年中展望中指出,美國最新的財政預算可能對美國國庫債券產生長期負面影響。與此同時,雖然美元在可見未來料將維持其儲備貨幣地位,但對美國經濟成長放緩、美國財赤可持續性以及地緣政治緊張局勢升溫的憂慮均促使投資人重新審視美元的主導地位。我們認為,相關因素將在未來一年內導致資金進一步從美元回流。

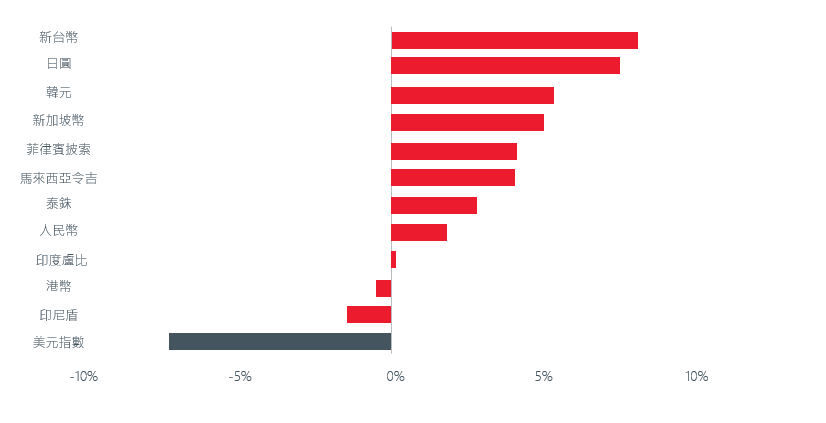

亞洲貨幣有望因此走強。近月,美元兌大部分主要貨幣貶值,包括亞洲貨幣。見圖1。此趨勢提高了當地貨幣債券對外國投資人的吸引力,因為貨幣升值能增加總報酬。另外,隨著美元走弱,美國國庫債券及其他美國資產的相對吸引力下降,可能促使投資人分散投資,並尋求風險報酬狀況更理想的替代資產。對於希望分散風險的美元投資人而言,投資於亞洲貨幣資產亦可能是吸引選項。

圖1:亞洲貨幣兌美元走勢(年初至今)

參考來源:彭博。截至2025年5月15日

亞洲當地貨幣債券提供分散投資優勢,因為相關資產與美國公債及其他主要已開發市場債券的相關性為低至中等。面對當前動盪市況,這一特點的價值日益顯著。圖2。

圖2:債券報酬率之間的相關性

資料來源:彭博、國際金融協會。2025年5月

此資產類別的成熟程度亦大幅提高。截至2025年4月底,亞洲當地貨幣債券的廣泛市場基準Markit iBoxx亞洲當地債券指數的市值已達到13,390億美元,涵蓋來自300多個發行人的超過1,800隻債券,其市場規模不僅反映亞洲的經濟增長,亦反映監管改革成效以及外資參與度增加。隨著更多亞洲當地貨幣債券納入全球基準,預計將有更多被動型投資資金流入,進一步利好債券估值。例如,印度政府債券自2024年起納入摩根大通新興市場政府債券指數,而韓國債券已計劃於2026年4月納入富時羅素世界國債指數(註)。

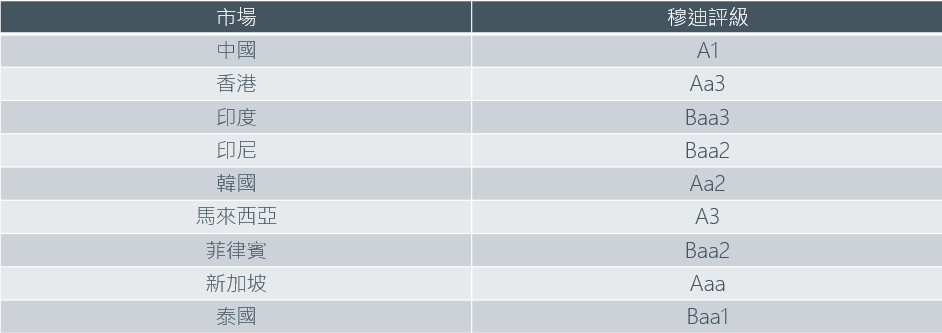

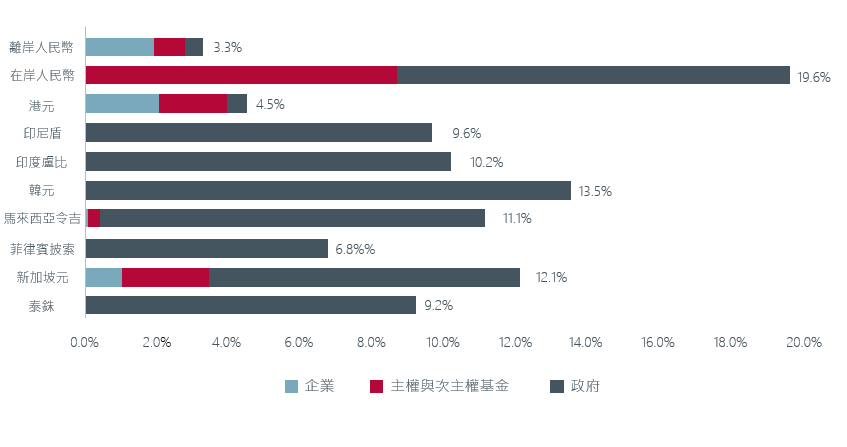

亞洲主權基金是當地貨幣債券指數的主要發行人。多個亞洲政府債券市場均擁有投資級別評級,有望為投資人提供兼具質素債券及報酬的選項。圖3。中國、馬來西亞、新加坡及泰國的企業發行人相對活躍。圖4。

圖3:亞洲-國家/地區評級(穆迪)

資料來源:穆迪,截至2025年4月30日

圖4:按貨幣劃分的行業分佈

資料來源︰瀚亞投資。Markit iBoxx亞洲當地債券指數。截至2025年4月30日。由於四捨五入,呈列的數字相加起來未必與所示總數一致。出於同樣原因,百分比未必反映絕對數字。以上圖表僅供參考用途,並不是有關市場的未來表現或可能取得之表現的指標。

實際收益率:亞洲的低調優勢

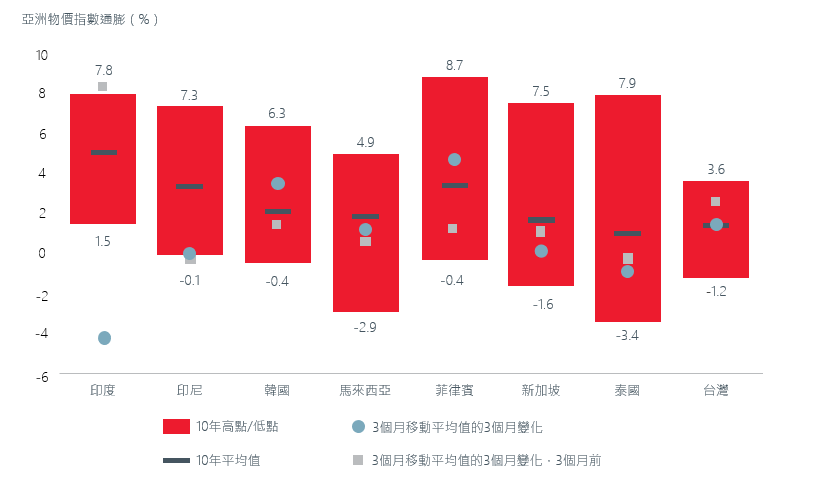

雖然美國及歐洲部分地區的通膨仍然高漲,但亞洲的情況卻有所不同。亞洲央行大致已有效控制通膨預期。圖5。以印度為例,在食品價格下跌的帶動下,通膨已回落至按年3.2%的六年低點。菲律賓也處於溫和通膨,其國內需求疲弱使央行得以維持鴿派立場。

圖5:亞洲通膨似乎受控

溫和通膨為亞洲央行帶來調整空間。2025年至今,印度、印尼、韓國、新加坡、中國、菲律賓及泰國的央行均已降息或寬鬆政策。預計政策將在未來進一步放寬。政策的靈活性對債券價格帶來利多效果,並為尋求收益的投資人提供穩定環境。

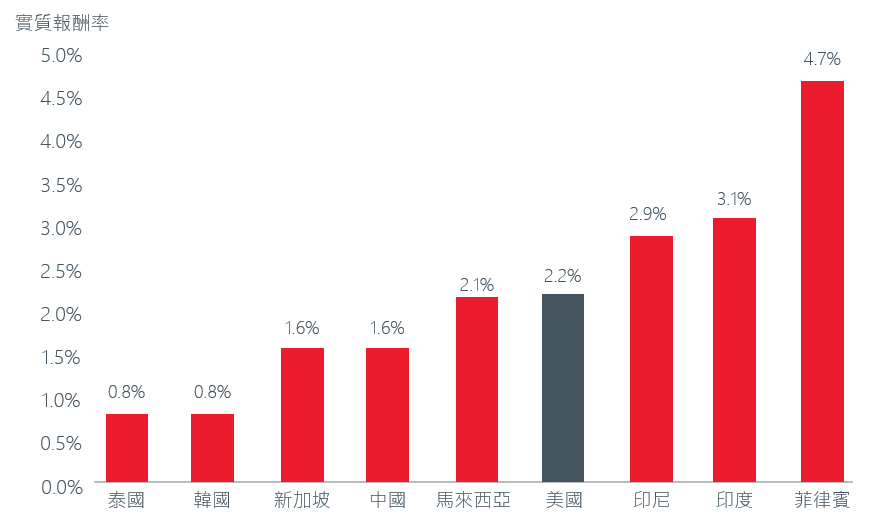

由於通膨受控及名義報酬率仍然偏高,亞洲的實際報酬率在全球市場名列前茅。例如,印尼、印度及菲律賓的實際報酬率目前均高於美國。圖6。

圖6:亞洲與美國實際報酬率的比較

資料來源:彭博。2025年5月。通膨數據為最新可得數據。由於部分當地貨幣債券的買賣價差較大,某些報酬率可能為估算值。

亞洲債券的這種報酬率優勢不僅源於政策利率,其反映了更深層的結構性優勢,例如審慎的財政管理、信貸基本因素改善,以及國內投資人基礎不斷擴大。

除了潛在降息的利好因素外,多個市場亦受惠於印尼、馬來西亞、印度、韓國及中國的強勁內需等特殊推動因素。另一方面,新加坡是全球少數仍獲評為AAA級的政府債券市場之一,並憑藉其低波動及高信用評級而享有避險資產地位。

理想進場時機

亞洲當地貨幣債券提供市場鮮見的優勢,兼具收益、穩定性及分散投資的特點。隨著全球經濟秩序演變,相關資產能夠在全球債券投資組合中發揮關鍵作用。由於美元受壓、亞洲通膨溫和,加上實際報酬率高,現在可能是投資人深入了解亞洲當地債券市場優勢的理想時機。印尼及馬來西亞﹙程度較輕﹚等市場的報酬率曲線陡峭,為投資人帶來部署存續期策略的良機,尤其是在預期降息前夕。短期而言,貿易緊張局勢、地緣政治風險及美國貿易政策的不確定性引發市場波動,可能為靈活的主動型投資人創造進場機會。

註:Markit iBoxx 亞洲當地債券指數

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. - UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing.

Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc (a company incorporated in the United Kingdom).