亞洲地區在2022年和2023年預計迎來全球最快速的經濟成長。與此同時,亞洲地區的通膨依舊溫和,讓多數亞洲央行可以持續以寬鬆的政策支持剛起步的經濟復甦。在此經濟前景下,我們強調將推動新的投資,並且重塑成長動力的三個領域。

向數位經濟轉型

毫無疑問地,疫情凸顯了網路經濟的重要性,加快電子商務、銀行、教育、醫療保健、物流和資料中心等數位化發展。此外,數位化也提高了印度等新興國家的生產力,印度過去五年的網路使用者已經新增超過4億人。

為了提高數位經濟在GDP中的比重,亞洲國家紛紛公佈嶄新的經濟成長藍圖:

• 印尼:宣布《數位印尼路線圖》(2021-2024)。

• 泰國:實施工業4.0轉型,將經濟成長動能從重工業轉向創新領域,並以稅收優惠推動對區塊鏈技術、雲端計算及資訊科技安全的投資。

• 馬來西亞:為2025年前的數位投資編列700億馬幣預算。

• 新加坡:分配更多資源用於通訊技術。

• 日本:優先考慮數位投資,2021年9月由政府主導啟動Digital Agency,期待以此加快公共部門的科技應用。

伴隨數位轉型,就業環境也正在發生變化。由於疫情讓許多人失業,打零工的趨勢增加,新的數位平台也紛紛湧現搶占零工商機。這些數位平台幫助中小企業按照需求管理員工數量,除了能協助企業壓低人力成本,也同時可以快速媒合零工者提供工作機會。更甚至,馬來西亞已將零工經濟認定為未來潛在的成長亮點,並將其納入第12個馬來西亞計劃(2021-2025)。

儘管如此,數位化的加速卻也擴大了數位鴻溝。弱勢群體很可能因為沒有網路和智慧型裝置,無法獲得優質教育、醫療服務、就業及其他社會福利的機會。因此,確保數位經濟以包容及平等的方式發展將成為挑戰。

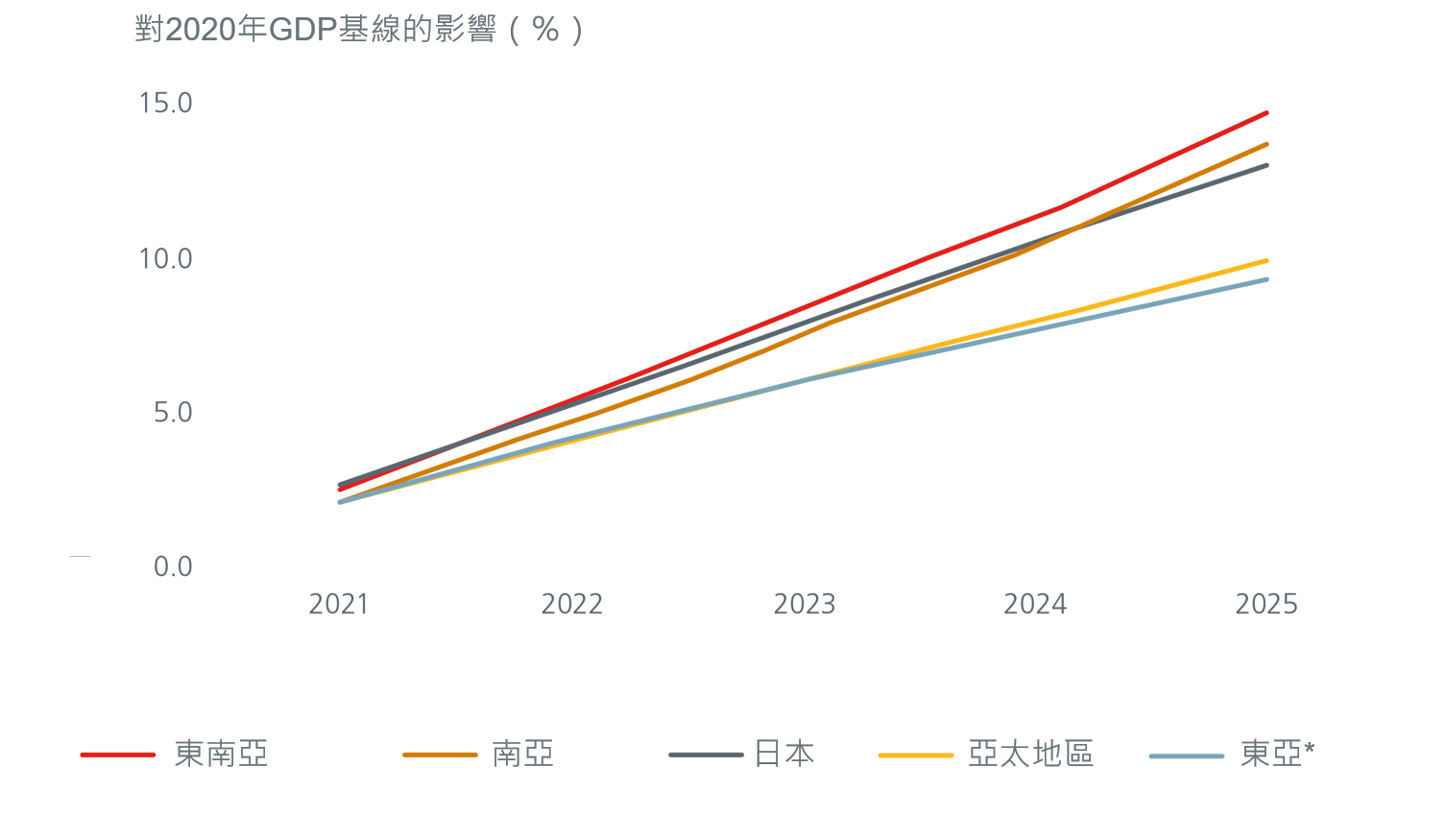

數位產業對亞洲GDP的影響將大幅提升

資料來源:Statista,2021年11月。*排除中國和日本

製造業升級

製造業主導的出口活動,將持續帶動亞洲的經濟復甦。製造商應將直接投資分散風險,建立靈活應變的供應鏈,是人們從疫情汲取到的重要教訓之一。現階段的亞洲製造商在數位科技的輔助下提高產能,並尋求利用外國直接投資(FDI)撤離中國的機會。

有利的政策環境、結構性的改革以及全球企業一致希望供應商基礎多元化的趨勢,已幫助印度許多產業恢復出口並提高產能效率。在越南,由出口產品驅動的電子業也正是供應鏈多元化的最大受益者。

為了推動新的投資,東協提出精簡負面投資清單、增加經商便利性、實施減稅、為經濟特區和工業園區提供財政激勵及增加基建支出等政策。印尼訂定了《創造就業綜合法》讓勞動市場更靈活,希望打造更好的商業環境以吸引外國直接投資;泰國則提出將東部經濟走廊作為工業重地,吸引對智慧電子及機器人投資,讓泰國與經貿夥伴的關係更緊密,促使全球貿易和供應鏈的更進一步融合。

轉向永續投資

此外,疫情也迫使亞洲各國政府關注環境保護、社會責任及公司治理(ESG)議題,刺激潔淨能源和電動車等新興產業的發展。例如,印尼一直嘗試利用豐富的金屬儲備發展電動車和電池產業,使印尼將來有機會成為全球電池產業的重要夥伴國。馬來西亞方面,曾因疫情而停滯的永續能源產業正在復甦,馬來西亞政府已經啟動價值40億馬幣的1瓦特(GW)太陽能招標,馬來西亞的大型融資機構亦正從燃煤等高汙染產業撤資以落實ESG原則。

最近推出的FTSE4Good Bursa Malaysia Shariah Index以伊斯蘭教法為核心落實ESG原則,除了能滿足社會的永續發展需求,也符合了伊斯蘭教法的投資需求。

新加坡方面為了有效應對氣候變遷,將資源投注於海岸及洪水防護基金;韓國公布氫能經濟振興路線圖,目前已促使企業宣佈在2030年之前推出超過43兆韓元的投資計劃。此外,日本政府也日益關注國內的減碳,多家日本企業已開始制定具體的減碳目標,希望透過產業的綠色轉型提高日本企業的全球競爭力。

投資影響

儘管亞洲國家的前景仍喜憂參半,但在企業方面有積極跡象,超過三分之二的亞洲企業在2021年第三季度意外有正面盈利,且隨著亞洲各國的復甦,未來盈利可望再上調。此外,基於上述成長動能,多個產業有望成為企業和公共部門投資增加的受益者。

目前我們認為以下產業的獲利將提高,進而獲得穩健股息:

銀行業將受益於上述領域對新投資貸款的龐大需求。新冠肺炎疫情期間,在貸款成長但存款成本仍然很低的趨勢下,擁有足夠準備金和充足資本的銀行處於更有利的地位。經濟確定性較高的區域(健康的GDP成長率、房價較高、強大的勞動市場較等)內經營的銀行應能夠透過特別股息或回購來降低資本比率。

科技投資方面,我們認為未來將保持強勁成長動能,且更集中於金融科技、健康科技及教育科技的發展。我們認為半導體、軟體、電子商務和網際網路領域有良好的投資潛力。例如,電動車和雲端計算需要高效能的半導體和電子元器件。我們看到半導體產業提供了超額的股息收益率,尤其是在台灣。在永續投資方面,我們也認為電動車公司及其上游供應商具有投資價值。

最後,由於各國政府與企業都在尋求更穩定安全的供應鏈,產業或多或少會出現去全球化或供應鏈區域化的現象,中小型企業的股票便有機會從產業回流中受益。此外,對於中小型企業股票估值的低估,也將對投資中小型企業股票帶來利多。