所謂「趨勢」,正是一種大規模的變革動力,對於企業和社會產生深刻且長久的影響,進而改變世界。了解大趨勢如何影響全球各個產業的營運,對於有興趣投資新興產業的投資人而言,至關重要。

氣候變化、可再生能源及碳中和:電動車

中國的碳排放預期將在2030年前達到巔峰,中國政府則表示:希望在2060年前實現碳中和目標。了解環境保護意識可能對全球能源產業帶來的影響,堅定了我們看好電動車產業和其供應鏈上游的供應商(例如:鋰電池的分離器廠商)的未來投資前景。

我們認為,台灣完善的半導體產業鏈將從全球電動車需求成長中受益。未來五年內,電動車的需求會帶動半導體晶片產業,有利於台灣具產業領導性地位的代工廠和IC設計公司。此外,半導體需求的增加也有助於電子零組件的公司發展,例如:能為高階中央處理器中複雜積體電路提供絕緣的先進積體電路基材(高階IC載板增層材料ABF或味之素堆積膜)。

不斷變化的人口結構

未來數十年內,亞洲將成為全世界平均年齡最大的地區之一,預計本世紀亞洲65歲以上的老年人口將達到近9.23億 。儘管如此,亞洲仍有許多地區繼續享受龐大年輕人口的紅利,例如越南的年齡中位數為32.5歲 。

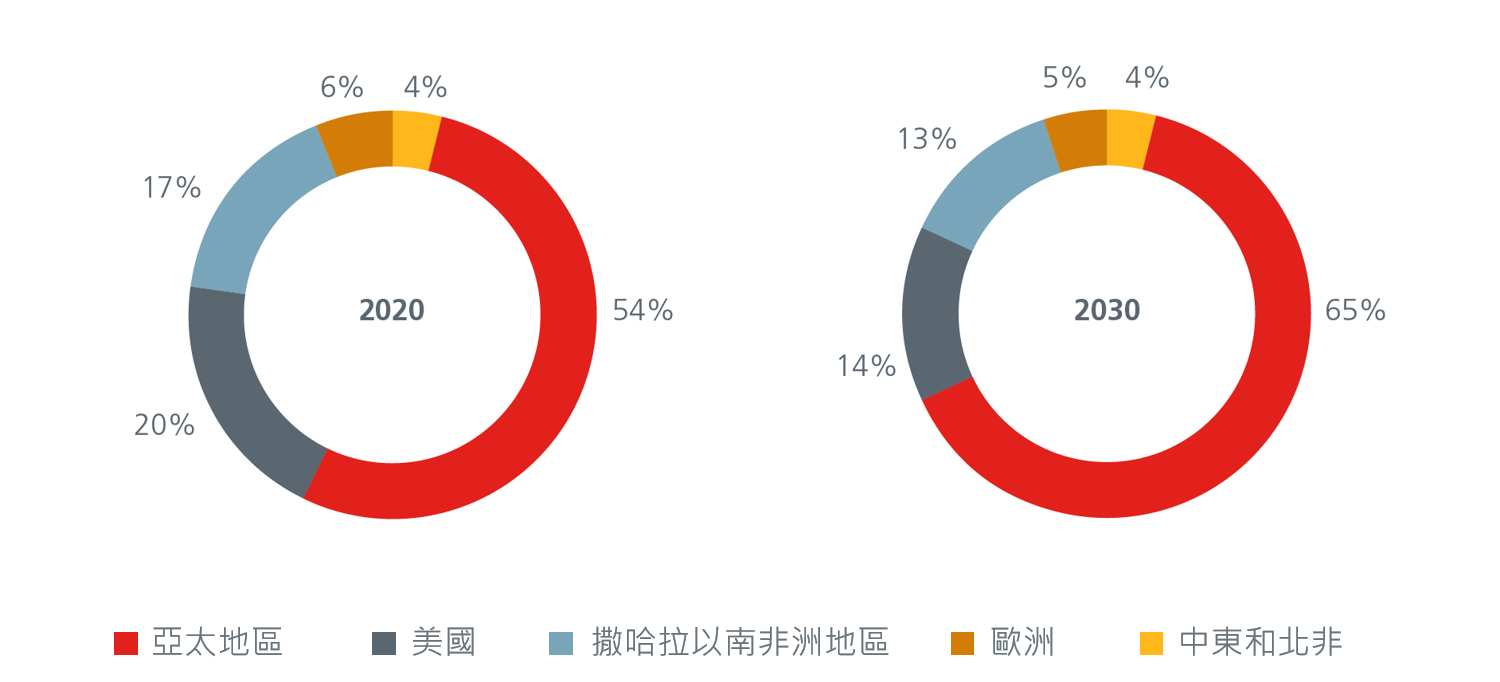

與此同時,中產階級的人口將在未來15年內持續增加,2020年亞洲約有20億人處於中產階級,預期到了2030年將達到35億;相比之下,美洲和歐洲等成熟國家的中產階級規模則呈現成長停滯。對越南等新興國家而言,經濟成長漸漸從農業轉至工業和服務業主導,在龐大年輕人口的支撐下,對中產階級的崛起是一大利好。

亞洲中產階級勢必不斷成長(全球中產階級佔比按地區劃分)

資料來源:布魯金斯學會。中產階級的定義為2011年每日人均收入在11至110美元(購買力平價)的家庭。

亞洲不斷變化的人口結構及成長中的中產階級將影響消費趨勢,數位化及永續發展等趨勢將被廣泛接納,進而為金融服務、醫療保健、消費品及綠色產業提供新的投資機會。

數位化及自動化程度提高

最近一項調查中 ,認為數位化是東協企業在疫情期間能夠持續運轉的關鍵,對東協未來的經濟復甦也有重要地位。87%的受訪中小企業表示,數位化讓生產流程自動化,除了提高效率,也讓企業能夠更便捷地取得資訊、有更多商品和服務的選擇。此外,數位化也在疫情期間成為替代收入的來源。

金融服務也是數位化趨勢中有重大轉變的產業。數位銀行及電子支付的普及,促進了數位帳戶、線上投資及電子商務活動。據觀察,越南的大型商業銀行的資本支出中,有20%至70%用於數碼化。根據國際數位資訊公司(International Data Corpation)及數位銀行平台Backbase的報告顯示,預計到2025年亞太地區將成立100家的新金融機構。

了解科技如何透過5G、雲端運算及機器學習等技術創新以及企業如何調整商業模式,將有助於我們掌握軟體業、電子商務及網際網路領域的嶄新投資機會。

加密貨幣

加密貨幣的未來投資潛力仍然是辯論中的話題。擁護者認為加密貨幣的重要性等同黃金,質疑者則視加密貨幣風潮僅是一時狂熱。雖然加密貨幣目前看似有較為長期的潛力,但我們認為目前將加密納入投資組合以尋求多元化優勢為時尚早。

黃金已被證明在平衡性投資組合中(例如:股票債券組合)在經濟大環境變動時,能夠有效地保持投資組合的績效表現;但對於加密貨幣來說,因為現階段的樣本模型仍過於侷限,目前無法得出任何定論。如何適當地管理風險也是投資加密貨幣的一大挑戰。

投資人除了需要留意近期影響投資前景的通膨、利率、GDP成長等因素,更需要關注能對全球帶來重大影響的顛覆性大趨勢。投資任何趨勢時,應了解新商業模式的商業性、永續性及管理團隊的執行能力,並時時追蹤業務的發展,掌握產業的機會與風險。

科技的技術突破及新興產業的最大風險之一,正是政府的干預和監管不斷增加,即使大趨勢極具投資潛力,投資人仍應反覆確認市場價格相較於產業估值是否超越合理的現實水平。